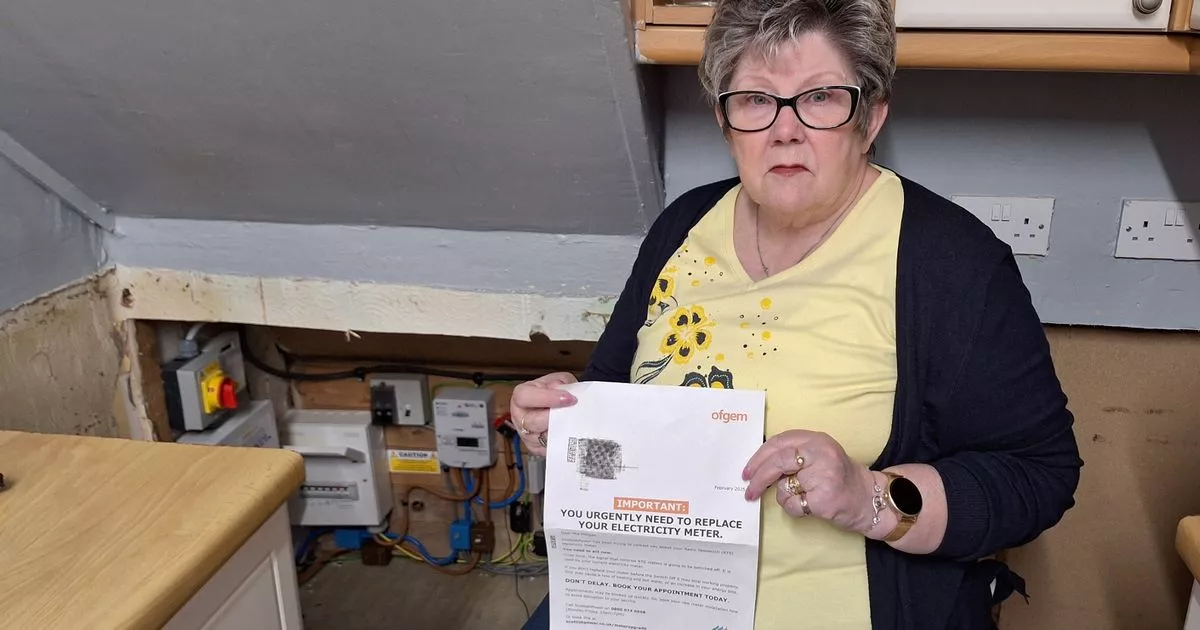

The Chinese national flowed with the Financial District of Lujiazui in the background.

Vcg | Visual China Group | Getty images

Financial institutions are rethinking their calls in China after a surprise exchange between Washington and Beijing, which increases the country’s growth forecasts and stock market prospects.

On Monday, the United States and China reached an agreement to temporarily stop the majority of tariffs on the products of others for 90 days. According to the agreement, mutual tariffs will be reduced from 125% to 10%.

This marks a significant flexibility of tensions between the two countries after the Tit -for-Tat that followed after the “reciprocal” rates of the president of the United States, Donald Trump, on April 2, which led to a strip of banks that reduced their Chinese growth forecasts.

Now, several institutions are reviewing their perspectives from China.

UBS said in a note on Monday night that China’s growth in 2025 could rise to between 3.7%and 4%, above an anterior base case of 3.4%, given the way in which the display of the commercial war could lead to a “lower shock” to the Chinese economic.

Morgan Stanley has also raised its quarterly GDP quarterly forecasts of the short -term quarterly China on the expectations that companies can try to accelerate exports to take advantage of the lowest rates.

“While the tariffs remain high, the suspension window could lead to shipments and production loaded with front,” wrote the investment bank analysts in a note. The GDP of the Second Quarter of China could reach higher than the current estimate of 4.5%, wrote the main economist of Banco Robin Xing and others in the report.

In addition, Xing and his team now expect the growth of the third quarter to show a temporary resilience, predicting that it is above 4%. Previously, Morgan Stanley had said that growth could soften around 4%.

Anz Bank now sees the potential for China’s GDP to arrive at more than 4.2% this year, after the Australian -based bank checked its 4.2% of 4.8% prognosis in April.

Similarly, Natixis sees the country’s growth in 4.5% this year, above its base case of 4.2% if there is a more proactive stimulus and a greater reduction in tariffs. This occurs after the French bank reduced its Chinese GDP prognosis to 4.2% of 4.7% in early April.

Cautious optimism

Optimism in growth prospects is to improve the perspectives of Chinese teams.

Nomura has raised China’s actions to “tactical overweight” and has rotated some funds from his position in India to China, he said in a note after commercial conversations.

CITI has raised its objective for the Hang Seng index by 2% to 25,000 by the end of the year, and hopes that it reaches 26,000 in the first half of 2026.

Even so, the Citi Variable Income Strata in China, Pierre Lau, said it prefers national works that avoid tariff uncertainties. The neutral consumer sector has improved overweight. Lau also highlighted the country’s internet and technology sector as promising.

“We see an attractive risk reward in China’s shares with poorly demanding marketing market,” said MayBank Investment Director Eddy Loh, who sees opportunities in communication services and some discretionary sectors of the consumer.

William Ma, Grow Investment Group investment director, which typically has a leg in China, believes that the rebound in Chinese markets is a sustained reorganization, especially with the recent stimulus and stimulus of Chinese policy consumption.

The CSI 300 of China was marginally higher on Tuesday after increasing 1.6% in the previous session. Hong Kong Hang Seng index increased almost 3% on Monday, but fell 1.5% on Tuesday.

Some experts warned when they did not get carried away by what can be a tactical rebound in the actions.

While commercial conversations between the United States and China were better than the markets expected, the agreement remains temporary and is subject to more changes, Loh said.

This does not change the general panorama. China’s stock market still depends on the national foundations, which remain weak.

The reduction and 9 -day tariff rest does not guarantee an agreement, especially given the deterioration of mutual confidence between the United States and China, said Natixis’s main economist, Gary Ng.

The markets recovered because the results of the commercial talk were a surprise and not a price, said China director of Eurasia, Dan Wang.

“This does not change the general landscape. The China Stock Market still depends on the national foundations, which are still weak,” he told CNBC, citing the fall in the real estate sector and the increase in the support of the local government debt that is also the sector.

Trump, who sees tariffs as central for his political leverage against China, may not maintain low tariffs for a long time, Cheek added.

“This is a temporary hole, not an advance in the bilateral relationship. A 90 -day truce is short in commercial diplomacy,” he said.

—Velyn Cheng from CNBC contributed to this report.