From basic software suppliers that unite forces to new insurtech companies that are consolidated for scale and survival, the activity of treatment reflects a movement towards purphose integration in pure volume. In this blog, we examine three archetypes of agreements that make up the market, geographical nuances and introduction frames to analyze these movements.

We Also Highlight Notable Example From The Insurtech Ecosystem Such As Guidewire – Hazardhub, Duck Creek – Immburse and CCC – Safkeep, as Well as Discussing Strategic Drivers Entrythic), and geographic entrythic), and geographic entrythic), and geographic entrythic), and geographic entryuit), and geographic entrarate), and geographical entry), and geographical entry), and geographical entry), and geographical entry), and geographical entry) and geographical entry) geographical))) and Trys Roll-up, cross-border purchases).

Finally, we will predict how these trends point to a change of industry towards smart and compound insurance platforms.

Communicate to discuss this issue in depth.

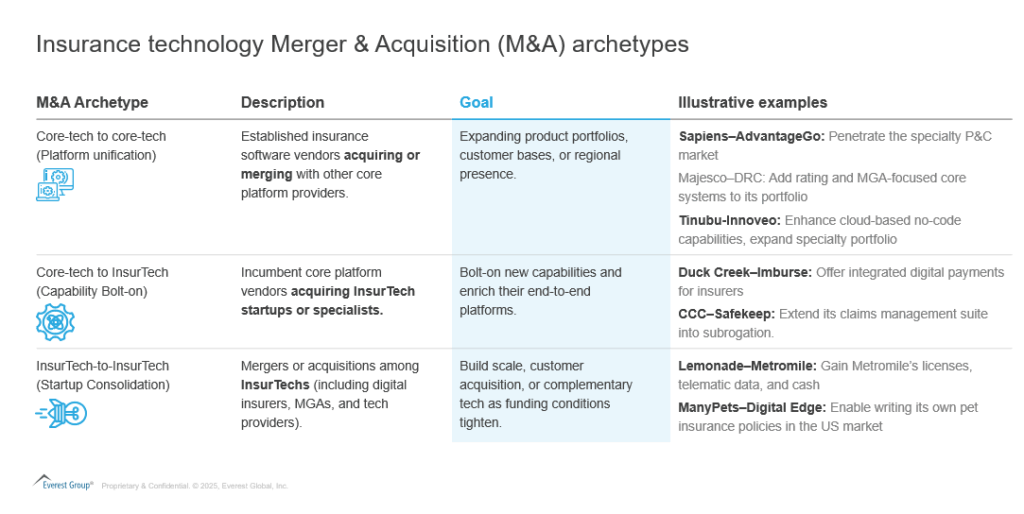

Fusion and acquisition of insurance technology (M&A) archetypes

The activity of mergers and acquisitions of the industry can be classified into three archetypes of main offers, each with different players and strategic objectives, but all contribute to the broader trend of the construction of ecosystems in insurance technology:

Each archetype reflects a different strategy:

- Central Technology Marias: Platform Unification Offers: Economies of scale and scope

These nucleus nucleus offers are aligned with a horizontal frame or integration, with suppliers that aim to become unique stores for the technological needs of insurers, a step towards the vision of the “composite platform”

- Core tech acquiring insurtechs: capacity bolt-to: Capacity expansion

Regular suppliers take advantage of M&A to accelerate their roadmap: it is faster to buy a tested technology than to build it. The ultimate goal is to build an integrated platform where additional capabilities (risk scores, payment rails, artificial subrogation (AI), etc.) are embedded in the central workflow, delivering the need for valpuming and reditomers

- Insurtech-to Inurtech: Consolidation for the scale

Insurtech offers to Insurtech are often trying to combine customer bases or capabilities to achieve critical mass. Many new subsequent companies faced a growth challenge versus profitability, some, unable to ensure new funds in favorable terms, choose to merge with their peers or acquire being acquired

Volume and value of m & a by region

- North America: Approximately 60-70% or the Insurance Technology M&A agreements have target companies based in North America. The US Remains the Largest Hub for Insurtech Activity, Accounting for Half of All Insurtech Deals in Q1 2025. North American Targets also Represented the Majority of Disclosed Deal Value in this Period, Thanks to Big Ticket transactions like duck Creek Creek Creek Creek Creek Creek’s Likeqet Creeks Likeqet Creeks Likeqet Creeks Likeqet Creeks Likeqet Creeks Likeqet Creeks Likeq in Likeqet Creek’s Like Qet Creeks $ Duck.

- Constant contribution from the United Kingdom and the EU: The United Kingdom and the EU represent 30-40% of the volume of the agreement. The United Kingdom is the leading insurtech market of Europe, exemplified by agreements such as Sapiens – Advantage (Target of the United Kingdom) and Manypets – Digital Edge (acquirer from the United Kingdom). Continental Europe saw less large offers, but notable include the acquisition of Verisk from the Rocket software in Germany in 2024 and several private investments of equation (PE) in central technology companies (such as the Keylano of Europe was acquired by Pollet, a pollreet, a pollet, a pollreet, a pollard by Pollet, to Poly. The value of the agreement fluctuated, but included some significant transactions (such as the Digital Partners of Munich Re, the digital excursion to Many Pets)

- Apac and others: Asia-Pacific Insurtech M&A is growing from a small base, which represents 1–3% of the global agreement in recent years. However, there are emerging signs of cross -border interest (EC, a insurance software division of the Indian Information Company (TI) could go to Asian Insurtechs or Japanese insurers that invest in Insurtech companies). We anticipate that APAC’s participation rises as markets such as India and Southeast Asia produce more scaled insurtech that attract global buyers

The following strategic imperatives constantly appear as reasons in the thesis:

- Expansion and innovation of capacity: Perhaps the strongest controller is the need to quickly acquire new capabilities, be it advanced analysis, AI, digital participation or automation

- Composite product and platform portfolio: Insurers are increasingly looking for composite platforms, modular solutions that can connect and reproduce. M&A is allowing suppliers to assemble modular thesis components under the same roof and create a complete pile platform ecosystem. In doing so, they get closer to provide the elusive solution of “a stop” from end to end, while allowing customers to

- Geographical and client segment expansion: The following strategic movements reflect a Buy against building vs. partner Decision: Accelerate entrance to a market, buying a local player or a victory specialist. SAPIENS – Advantage clearly helped him enter the specialized sphere of Lloyd in London, the acquisition of Verisk of Rocket (a German insurtech) for a deeper footprint in Europe, Insurtech Manypets Acckans (US Carrier. Uu.) US cutter. UU.). On the side of the client segment, Majesco – DRC was part of going behind the narrowest insurance/mga (a majestic segment wanted to serve better)

- Customer scale and acquisition: Especially in Insurtech Insurtech consolidations, the reason is simply to acquire the business book or the user base of a competitor. With customer acquisition costs in insurance in insurance, buying a competitor can be cheaper than organic growth in some cases. Lemonade Essentialy and bought more than 100,000 Metromile car insurance customers along with their data instead of spending years to acquire that many new customers directly. This controller is related to the long -term consolidation trend: as markets mature, some platforms will accumulate most customers

- Private capital infusion: Physical education companies have been active acquirers or insurance technology companies, looking for a confinement strategy in many cases. For example, the purchase of view Duck Creek (2023) and the Clearlake capital acquisition chain through Zywave and Advisen (creating a power of insurance distribution software) are about financial sponsors that build larger entities to obtain value later. These PE roll-ups provide output opportunities for founders/investors and, often, instill to companies with additional acquisitions, continuing the cycle. Another issue is Insurtechs acquired by insurers or reinsurers: for example, travelers who acquire Cyber Mga Corvus in 2024 stressing that traditional insurance actors are also buying technological and digital capabilities, sometimes through their corporate

- Focus on profitability and central business: By 2023, there was a remarkable change in the tone: Insurtech Investors and together pressed for sustainable growth and profitability. As a result, some non -basic companies were stripped. For example, Lemonade, just after buying Metromile, he sold the Saas Enterprise Saas de Metromile platform to EIS (a central software company), essentially throwing a software business without insurance to focus on its main insurance operations. This indicates a rationalization in which Insurtechs double

FUTURE PERSPECTIVES: Towards smart and compound platforms

As we look to the future, the trajectory of merger mergers and acquisitions seems to be ready to continue, if not accelerate, to improve market conditions. Here are some prospective predictions:

- Resurgence of agreements in 2025: With stabilized assessments, we expect more medium -sized strategic acquisitions since both insurers and technology suppliers regain confidence to invest. He Light increase of the year after year (year -on -year) in Fintech M&C leaves in 2024 It suggests a broader recovery. In insurance technology, the new companies portfolio of mid -2010 is now mature, or an initial public offer (IPO) will enter or seek acquisition

- Private capital continues to hunt: Dry dust in private capital is abundant, and insurance software is still attractive to its recurring income. We are likely to see more purchases led by pe of both central technology suppliers and larger insurtechs, as well as Bolt-on-Ons platforms by PE-DED

- Insurtech and Fintech cross pollination: The lines between Insurtech and Fintech are rampant. Future mergers and acquisitions could attract adjacent domains players, such as a bank software company that acquires an insurtech or vice versa, to create multiple vertical fixing platforms. Some central insurance suppliers sacrifice wealth or banking products and could seek acquisitions in those areas. On the other hand, insurance companies can acquire Fintech capabilities for integrated finance and insurance combos

- Increased intelligent and compound insurance platforms: The best direction of the industry and the general issue of these agreements is the convergence towards platforms that are intelligent and modular. By intelligent, we refer to hepatic AI, Big Data and automation in its nucleus; By modular (compound), we refer to constructions as a set of interoperable services or application programming interfaces (API). We hope that the acquirers put even more emphasis on the insurgues driven by AI to incorporate intelligence into their offers.

- Additional consolidation – Feer, bigger players: The market is going from a fragmented set of points of points of points to a handful or ecosystem orchestradors. This could reflect other technological markets where giants emerge

In conclusion, the global insurance technology sector, subject to strategic realignment, with all the signals that point to an industry that refers to more integrated and intelligent platforms. The message is clear, to deliver value to the insurers in the next decade, the suppliers must solutions (modular and interoperable) but integral enough, and intelligent to attend complex insurance processes. It is likely that those who are having mergers and acquisitions to assemble such ecosystems enabled for ini emerge as the powers of the insurance market.

If this blog seemed interesting, see our infusion of the private capital: at $ 200 billion+ opportunity | Blog – Everest Group, which deepens another topic with respect to physical education.

For more information about insurance technology, communicate with Ronak Doshi,[email protected]Aurindum Mukherjee, [email protected]and Sawant Rugved,[email protected].