The United Kingdom government bond market is increasingly exposed to the risk of strong prices and sudden sales swings, warned the International Monetary Fund, due to a growing dependence on coverage funds and foreign investors.

In its annual health control of the United Kingdom economy, the IMF said that the Gilt market was showing signs of potential “vulnerability”, particularly that traditional long -term investors, such as pension funds, withdrawal of the maintenance of debt of the highest date.

According to the fund, the coverage funds now represent almost a third of all bond transactions in the United Kingdom, which increases groups during periods of market duration. It is more likely that these highly liver investors react quickly and unpredictably to changes in feeling, which leads to volatility of potential destabilization in guilt prices.

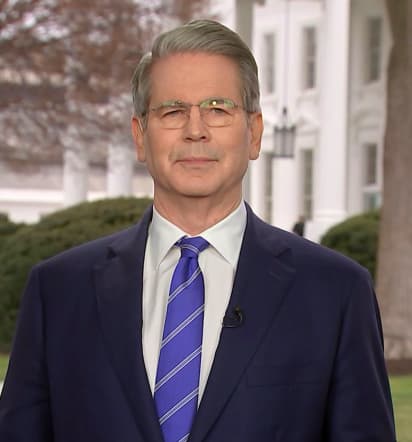

“When a large market proportion is a hero by entities with short investment horizons and high leverage, the risk of messy movements in the market increases,” said Luc Eyraud, head of Mission of the IMF to the United Kingdom.

The warning occurs when the United Kingdom faces the growing costs of indebtedness in the middle of a greater bond emission and a “quantitative adjustment” “by the Bank of England, which has been discharging golden since 2022. Both developments are the balance of weighing and demand.

The increase in bond sales by the Debt Management Office (DMO), which is raising capital to cover high public spending, have been added to the pressure. The IMF pointed out that the thesis conditions have contributed to the increase in yields, especially at the long end of the curve. The yield of 30 -year -old Gilts recently reached 5.5 percent, the highest in more than three decades.

The Fund praised the Bank of England and the Treasury for adapting its approach, partly Dimos’s decision to issue a shorter debt, which reduces the risk of blocking the highest long -term interest costs. The co-corner of Dmo, Jessica Pulay, recently said that the measure reflects the “Fortress in Declive” or the demand of long-term institutional investors.

The gold market of the United Kingdom was last thrown to agitation during the sequels of the mini budget of Liz Truss in September 2022, when a collapse of investors’ confidence forced pension funds to sell long -standing golden golden golds, which caused an emergency intervention by the Bank of England.

Since then, the feeling of the market has remained fragile, with the bond market of the United Kingdom highly sensitive to global events. The recent increase in yields has reflected the movements in the United States Treasury Bonds, triggered by renewed commercial war threats of President Trump.

In response, the IMF urged the United Kingdom authorities to maintain “nearby monitoring, regular stress tests and continuous commitment to market participants” to help detect early risks and prevent future destabilization. Although the fund recognized that the gold market has so far shown resilience, emphasized the importance of proactive risk management in front of a changing investor base and an uncertain global perspective.