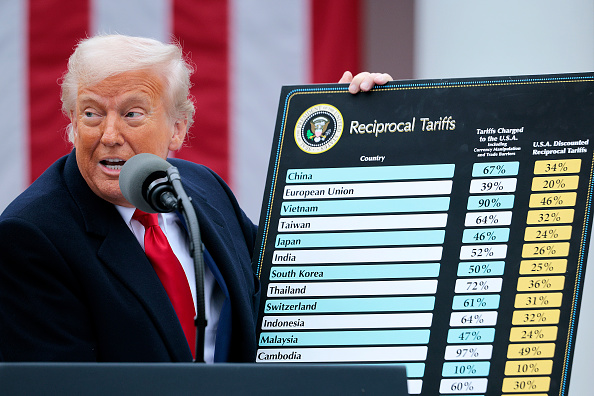

President Donald Trump has announced his commercial tariffs, and the United Kingdom is charged 10 percent from April 5, 2025.

The United Kingdom has bone as hard as other parts of the world, such as the EU, which has to pay a rate of 20 percent.

The United Kingdom companies that export to the US. UU. They will see the most affected. According to the BBC, the best -selling exports are cars (£ 9 billion), drugs and pharmaceutical products (£ 6.6 billion) and mechanical energy generators (£ 4.6 billion). In fact, the United States represents 40 percent or Sales of Astrazeneca and half or the clines of Glaxosmith.

Starmer says that a commercial war with the United Kingdom is not of national interest, but that it would reassure a commercial agreement with the United States. He has added that “nothing is out of the table.” It seems calm, advising the United Kingdom to “trust the process.” That said, there are reports that you are writing a list of American products to hit with tariffs.

But there is a reason for the group. Tina McKenzie, president of policies of the Federation of small businesses, said that 59 percent of small exporters in the United Kingdom are currently sold to the US market.

“The United Kingdom government should now be ready to provide emergency assistance to any SME at risk of collapse,” he said. “This will provide space for breathing, protect people’s salaries and ensure that OED suppliers payments are paid, all helping to contain the consequences and allow companies a bridge as they adapt.”

What should companies do now?

Business commentators have repeatedly noticed that companies are ‘staggering’ after the announcement of the rate, but what actions can you take as a owner at this time? Experts intervene about the current situation. We will update this section once Starmer has responded.

Balance pressure with opportunities

Ryan Fazackery, Cass Investment Company and Independent Bottler, whiskey 1901

“Faced with these challenges, the producers and investors of the United Kingdom should be kept attentive. The diversification of the markets is essential, ensuring that whiskey companies do not depend solely on a region for their export income. The strengthening of relations with emerging markets could provide coverage against the risks raised by global commercial disputes, assures a diversified whiskey holder A global attraction of any future.

“Brader’s tendency to increase global commercial tensions is a reality that whiskey producers and investors must face. To navigate the thesis challenges, the whiskey industry must adapt and maintain resistant, balancing the pressures of international trade with the main postpunitions for the application of prizes prizes.

Think about customer logistics

Robin Anderson, Chief of Product Management of Payments

“The merchants who send to the USs must now take into account the longer customs processing times, the highest compliance costs and the probable increase in customer service problems related to unexpected tasks.

“For companies that operate through the borders, the increase in tasks is not only a logistical headache, but also financial, threatening the margins already narrow and forcing a rethinking of their operational strategies. For online sellers, the coup effects can include conversions of reduced cars, payment disputes and an updated unexpected as the buyers react to the charges of the charges or of delivery.

“In this climate, smart -payment infrastructure becomes a key competitive advantage. Advanced payments can help merchants reduce transaction costs and avoid unnecessary rates. Faster settlements improve access to working capital and improved fraud mitigation tools help protect income when companies can pay losses.”

Optimize payments

Zaki Farooq, technology director and co -founder of Payfuture

“Companies can reduce costs optimizing their payment suppliers, using local acquirers and offering specific payment methods and payment currencies in the region that improve both acceptance rates and customer satisfaction.

“In this volatile environment, merchants must reduce possible friction and control costs. That means using local payment methods, real -time transfer rails and intelligent routing currency rates and improving approval rats.”

See also: The 9 best card readers for small businesses in the United Kingdom: these are the 9 best card readers that meet the demands of the scale of the scale companies for the cost, the transaction rates and the characteristics

External Foundation of Origin

Managing Director or Capital of AuroraGeorge Holmes

“Companies may need to seek external finances to manage the impact. It is important that financial lenders and institutions intensify practical support and flexible solutions. New commercial barriers.”

Focus on the United Kingdom and the EU, maintaining strategic associations

John Phillipou, president of Fla and MD of Pyme Linging in Paragon Bank

“Encouragingly, we are seeing a changing feeling towards European and national brands as customers seek to protect themselves against uncertainty, in turn creating opportunities for manufacturers in the United Kingdom. With strong local supply chains and quality reputation, British companies are well located to increase market share and benefit from the industry’s reinforcement trends.

“As the commercial landscape evolves, it is crucial that SMEs remain agile. With careful planning and strategic associations, the United Kingdom companies can prosper despite global uncertainties.”

Read more

Cheaper card payment suppliers: Here are the cheapest card payment machines for growing companies, including Sumup, Revolut, Square, Settle

Change in the company’s size threshold: could you cut your bureaucracy? – The size threshold of the United Kingdom will change in the new fiscal year. Thousands of companies will be reduced by size and reports to report requirements